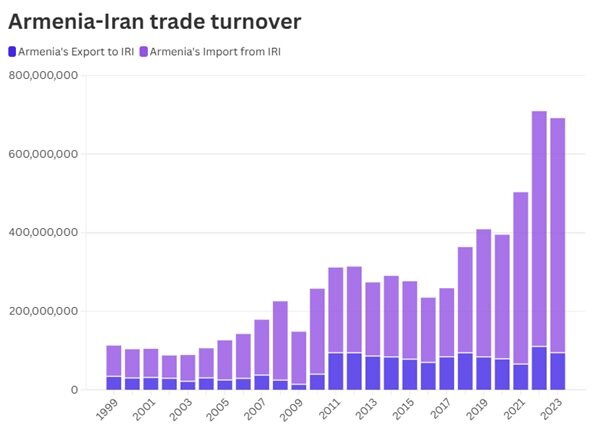

For years, Armenian and Iranian officials have set a $1 billion trade target as a desirable benchmark for trade between Armenia and Iran, and more recently, they have also discussed the $3 billion mark. As we observe the dynamics of Armenian-Iranian trade, it becomes clear that the $3 billion threshold is unlikely to be surpassed in the near future. Moreover, while we have slowly approached the $1 billion target, we have not yet reached it. However, we are getting close.

In 2021, Armenian-Iranian trade exceeded the half-billion-dollar mark for the first time, and in 2022, it surpassed $700 million. In 2023, according to available data, bilateral trade amounted to $690 million, showing a slight decrease compared to the previous year. Overall, the trend in Armenian-Iranian trade has been positive in recent years.

While this is certainly a commendable achievement, a closer look at the substance of Armenian-Iranian trade reveals some concerning trends. In particular, the trade balance is heavily skewed. Imports from Iran far outstrip exports. According to 2023 data, approximately 84 percent of Armenian-Iranian trade consisted of imports from Iran.

If we look at the data from the past 10 years, specifically from 2013 to 2023, we can observe that while both imports from Iran and exports to Iran have fluctuated—sometimes increasing, sometimes decreasing—the overall trend of exports from Iran to Armenia has been upward. In contrast, Armenia's exports to Iran have remained relatively more stable over this period.

I believe that trade turnover could experience more stable and faster growth if the issue of trade imbalance is addressed to some extent. Resolving this imbalance would also contribute to more stable and long-term economic cooperation. While such an imbalance is a natural consequence of the economic structures of both Armenia and Iran, it is encouraging that the issue is also being recognized in Iran. As such, both countries need to invest more effort into resolving it.

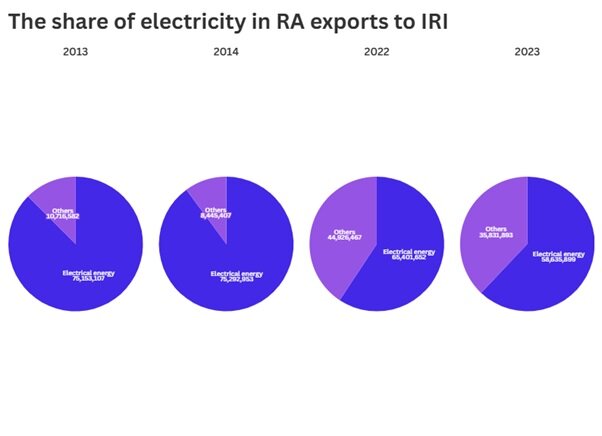

Another issue affecting our trade is the composition of Armenia's exports to Iran. More than 50 percent of these exports are electricity. In some years, the share of electricity in total exports has been as high as 90 percent— for example, in 2013 and 2014. Recently, the situation has improved somewhat; in 2023, the share of electricity was 62 percent. Additionally, the range of products exported to Iran has expanded.

Despite this positive change, electricity still dominates Armenia's exports to Iran. This indicates that while exports are increasing, there is still a pressing need to diversify the range of exported products.

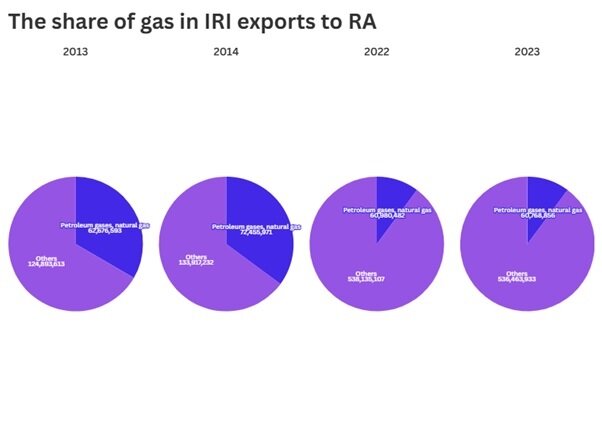

For comparison, while gas is the leading export from Iran, the products imported from Iran are much more diverse, and the share of gas in those imports is not as significant as the share of electricity in Armenia's exports to Iran. There have also been notable changes in this regard. In 2023, the share of gas in total exports from Iran to Armenia was just 10%, compared to 33% in 2013. This reduction is largely due to the growth of other product categories. Moreover, in 2023, the leading export from Iran to Armenia was iron and unalloyed steel. Other key exports included petroleum products, construction materials, fruits and vegetables, metals, pipes, detergents.

When we look at the leading products exported from Armenia to Iran, they have varied over the years, but the main categories have been as follows:

Copper

Cigarettes

Sheep and mutton

Chocolate

Iron and steel

Engines

Motorcycles

In 2020, due to the coronavirus pandemic, ethyl alcohol was also among the leading exports.

Another important factor I’d like to address is the impact of the temporary free trade agreement signed between the EAEU (Eurasian Economic Union) and Iran on Armenian-Iranian trade. Under this agreement, 360 products were included in the list of preferential and reduced customs duties for exports from the EAEU to Iran, and 502 products for imports from Iran to the EAEU.

To put this into perspective, three years before the agreement was implemented, in 2016, bilateral trade between Armenia and Iran amounted to about $230 million, with roughly 70% of that being imports from Iran to Armenia. Of those imports, only 12.3% came from product categories that were later included in the preferential list.

In 2022, trade between the two countries had grown to about $710 million, with 84% of that being imports into Armenia. However, the share of privileged goods in those imports had doubled, reaching 25.3%. This indicates that goods subject to preferential tariffs became cheaper for the final consumer in Armenia.

The situation is different when it comes to exports from Armenia. In 2016, before the agreement, 16% of Armenia's exports to Iran came from the product categories that were later included in the preferential tariff list. By 2022, this share had dropped to just 2.4%, mainly comprising chocolate and other related products.

In other words, the export of goods benefiting from preferential tariffs has decreased significantly, reaching a negligible level. This suggests that Armenian businesses, for various reasons, have not been able to take full advantage of the opportunity to export cheaper products to Iran's large market. This is in stark contrast to the situation in other EAEU member states like Russia and Kazakhstan, where more than half of their exports are in product categories that benefit from preferential tariffs.

Considering all this, I believe that such events provide an excellent platform to highlight the prospects and challenges facing the development of bilateral relations, including trade and economic ties, and to support the efforts to overcome these obstacles through joint action.

Finally, I would like to express my gratitude to our Armenian and Iranian colleagues for accepting the invitation of our center and for enriching this workshop with their valuable insights. I hope that the concerns and suggestions raised here will lead to practical solutions, thanks to the efforts of all of us. Thank you.

Zhanna Vardanyan, Orbel Analytical Center.

Your Comment